All the Chips in China

Core technologies cannot be bought. China must depend on its own efforts to narrow the existing gap in the high-end chip industry.

The alleged packaging of China’s first 4-nanometer (nm) chip has recently become a trending topic on the country’s social media platforms, with many netizens considering this a breakthrough in China’s semiconductor manufacturing. Packaging is one of the final steps in semiconductor manufacturing.

While chipmakers in the United States, the Netherlands and the Republic of Korea are working on 2-nm chips, the Chinese excitement about the 4-nm chips reveals a sense of national self-confidence as the U.S. has imposed multiple bans on chip and chip equipment sales to China since 2018.

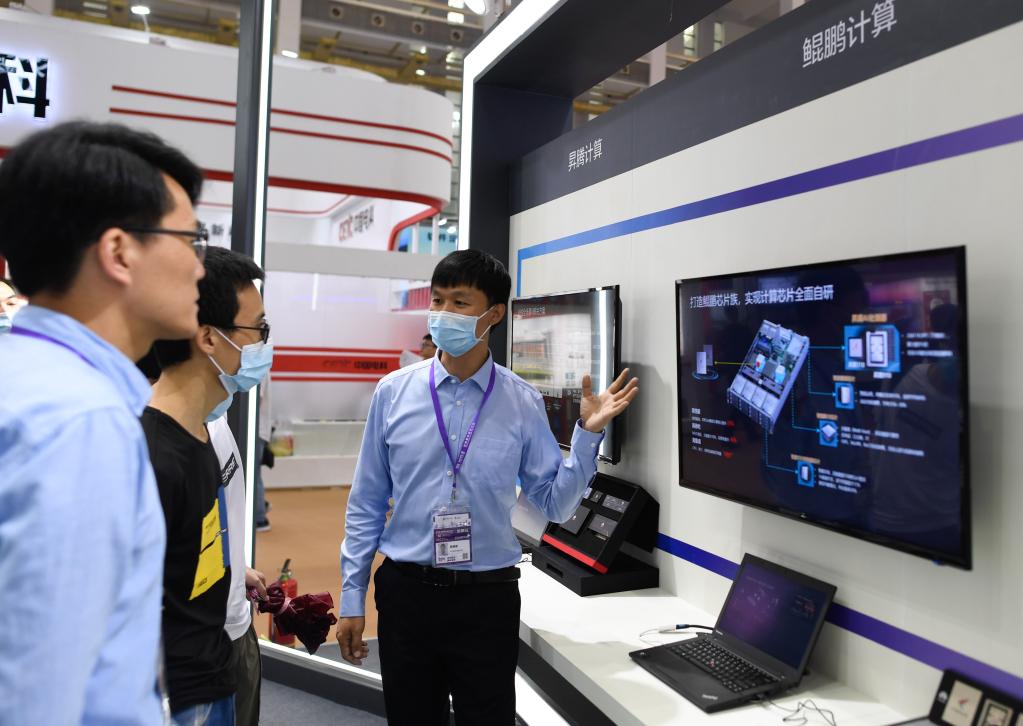

As core components of computers and an array of intelligent appliances, chips play an increasingly important role in the era of smart technology. However, China heavily relies on imported high-end chips.

In response to the American restrictions, the Chinese Government has increased its support to the semiconductor industry, stressing independent research and development (R&D). China is making serious efforts to close the gap between its own chipmaking technologies and those of advanced chipmakers.

According to statistics from the Ministry of Industry and Information Technology, R&D investments in China’s semiconductor industry jumped by 164 percent from 2019 to 2022. And with the sector also seeing an influx of private funds, one could argue it now has the support of the nation—as evidenced by the latest social media mania.

China will obviously still have to pick up the pace to catch up with state-of-the-art chip production, but based on the current momentum, the future of the country’s semiconductor industry is looking bright. The main question now becomes: How to really chip in?

Chip manufacturing involves several crucial stages. China is quite competitive in the fields of designing, packaging and testing. In 2022, Will Semiconductor Co. Ltd. Shanghai ranked second worldwide in terms of chip designing levels, while JCET Group Co. Ltd. ranked third in packaging and testing. But the country lags significantly in chip manufacturing equipment and heavily relies on related imports.

Then there’s the fact that Chinese chips have a huge domestic market. The U.S. blockade is depriving high-end chipmakers of the vast Chinese market, which is likely to slow down the overall development of the global chip industry. Products based on advanced technology must first enter the market for consumers to see if they are satisfactory or not. After all, the progress of technological products is based on consumer feedback.

At the present stage, both domestically and internationally, 70 percent of household appliances, automobiles and personal computers need 14- or 28-nm chips, which means China’s homemade chips can meet domestic demand for these products.

The cellphone industry is hardest hit by the U.S. ban since production of these gadgets depends on 6- and 4-nm chips—which are in the nascent stages in China. This explains why the ban crippled Chinese tech titan Huawei’s cellphone production. However, overall, Chinese chipmakers can manage the turmoil caused by U.S. restrictions as revenues from selling 14- and 28-nm chips can be used to bankroll their R&D of more advanced 6- and 4-nm chips.

Core technologies cannot be bought. China must depend on its own efforts to narrow the existing gap in the high-end chip industry. In the past decades, China has made great headway and even overtaken other global hardhitters in some industrial areas, like high-speed railway development. Its chip industry is likely to follow the same track.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +