Beijing Stock Exchange Places China’s Financial Industry in ‘Position of Strength’

China is playing it smart with plans for the Beijing Stock Exchange. China’s SMEs will benefit greatly from the project.

The Chinese government holds no intentions of taking a passive approach should leaders in Washington, London and Brussels choose to pursue China containment and economic decoupling strategies. For the moment, anti-China sentiments have risen at alarming levels in Australia, United States, Canada, United Kingdom and European Union. Accordingly, there’s chatter among investment bankers in New York, London and elsewhere that stock exchanges outside of Asia could block IPO’s (initial public offerings) registrations from companies based in China’s mainland.

The US SEC (Securities and Exchange Commission) has already imposed strict scrutiny over the applications of IPOs from Chinese companies and don’t be surprised if Washington places added pressure on other international stock exchanges to follow up on similar procedures. The US government believes they have the upper hand to force Beijing to bow down to their wishes but that’s unlikely.

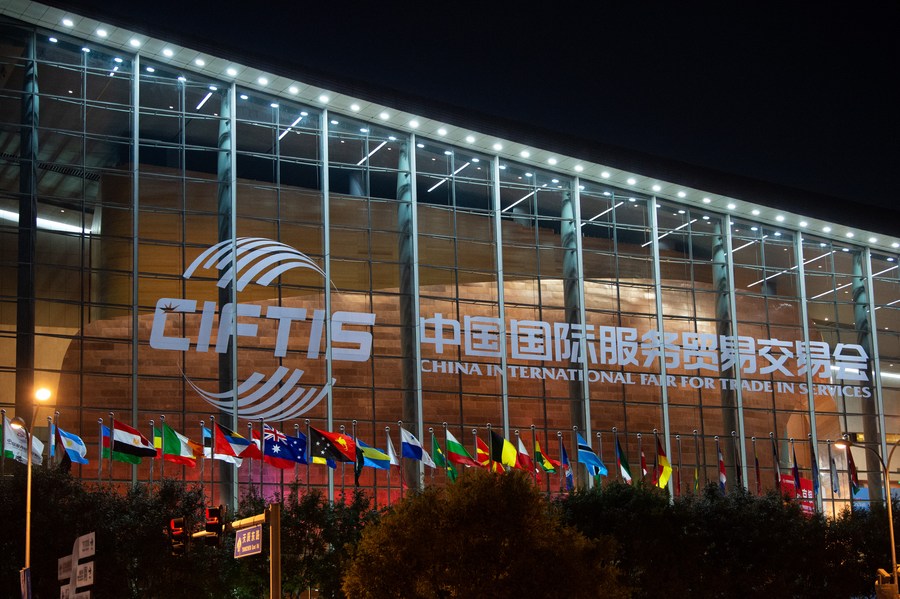

The Chinese government’s response is to boost its domestic financial industries, encourage Chinese publicly-shared companies listed in US stock markets to return to re-listing on the bourses of Hong Kong, Shanghai and Shenzhen. And there’s a new twist. Chinese President Xi Jinping delivered a keynote address at CIFTIS (China International Fair for Trade in Services) on September 2 in Beijing and he announced plans for the opening up of the Beijing Stock Exchange. He assured the public that China will deepen reforms in the financial services sector while the new stock exchange will serve as an alternative finance mechanism for China’s small and medium-sized enterprises (SMEs).

The Beijing Stock Exchange will be dubbed, “New Third Board,” which is an upgrade from a market entity currently known as the “National Equities Exchange & Quotations” (NEEQ).

Diving into deeper details

China’s mainland two major stock exchanges, such as ChiNext in Shenzhen that was launched in 2009; and Shanghai-based STAR board in 2018 also promote SMES for public listings. They are similar to NASDAQ, a stock exchange for over-the-counter publicly traded companies that are heavily weighted with science and hi-tech companies. Sci-tech firms are considered high risk as the startups are routinely low on capitalization at the beginning while many of them go bankrupt for failing to generate sufficient revenues.

Accordingly, the China Securities Regulatory Commission (CSRC) had required high market capitalization and revenues for companies to qualify for IPOs listed on the bourses of Shanghai and Shenzhen. The requirements are stringent, so Beijing has tried to make it easier for companies to get listed with STAR but there had been unexpected delays and challenges that ensued. Hence, the Beijing Stock Exchange opening up is expected to introduce 66 “select” stocks listed on the NEEQ for public-trading, which include the companies Speedbird, a metal sheet manufacturer; Tongyi Aerospace, a specialized rubber products maker and Zhulaoliu, a packaged food firm, according to CNBC.

The Beijing Stock Exchange has already announced a gathering for public comments that will continue until September 22 to address operations’ rules, as well as the procedures for listing, trading and membership management on the new bourse. As of Sept 3, CGTN reports, the Beijing Stock Exchange has completed its registration with capital – 1 billion yuan ($155 million), according to the National Enterprise Credit Information Public System. The NEEQ serves as the sole shareholder.

The Beijing Municipal Administration for Market Regulations granted approval for the ‘Third New Board.’ Nonetheless, BSE stocks can only originate from companies listed on the NEEQ for 12 months and there are price target restrictions and holdings limits. Price movements are not restricted on first day of trading, but they can be suspended for 10 minutes during market hours if the price rises by over 30 percent or drops 60 percent. After the stock’s first trading day, daily price movements can’t exceed 30 percent up or down and if so trading restricted that day. In regards to IPO pricing, the target price can be no less than 80 percent of the market price. After an investor purchase the stocks they cannot sell it until at least six months later. In other words, the Beijing Stock Exchange will not act similar to other stock exchanges where traders can buy and sell the same shares within seconds or minutes.

Easier for SMEs

Despite the strict trading rules, President Xi has offered words of praise:

“We will continue to support the innovation-driven development of small- and medium-sized enterprises (SMEs), by deepening the reform of the New Third Board (National Equities Exchange and Quotations) and setting up a Beijing Stock Exchange as the primary platform serving innovation-oriented SMEs.”

Cao Yanghui, director of Nanhua Futures Research Institute, a brokerage based in Hanghzhou, explained to CNBC that the announcement of the Beijing Stock Exchange demonstrates how China is “proceeding at a relatively fast pace” to revamp China’s IPO registrations to make it easier for SMEs to go public. “If everyone felt previously that the (IPO) registration system was rather distant, then it may now be close at hand,” Cao added when speaking with CNBC.

The Wall Street Bank Morgan Stanley delivered a positive statement as well in a note posted by one of its equities analysts, Katherine Liu. “We see Beijing Exchange as positioned to support mid/small-sized firms and as a hub where the best of those firms can go to list on Shanghai and Shenzhen exchanges.”

It should be noted that companies expected to join the ‘Third New Board’ will not be SMEs that are science or hi-tech oriented. They will be more focused on services and supply chains. The Diplomat magazine speculates that the Beijing Stock Exchange would replicate Germany’s Mittelstand, ‘Rhineland capitalism, which favors networks of highly-specialized firms contributing to global supply chains of world-leading advanced industrial products.

Additionally, SMEs that are private enterprises have long struggled to receive loans and generous financing from China’s state-owned banks. Meanwhile, the CSRC described the Beijing Stock Exchange as a “major strategic development” to promote high-quality development of China’s capital markets, as reported by Quartz. China is taking the right steps here.

Going into overdrive

China is playing it smart with plans for the Beijing Stock Exchange. China’s SMEs will benefit greatly from the project. The stock markets in the US and Europe have been very influential over the capital markets but new global trends are emerging. More fortunes are blowing eastward and China has enjoyed rapid development and strong economic growth rates over the past four decades since the Reform & Opening Up policy started in December 1978.

Chinese companies have been held captive to the political whims of Washington, London and Brussels, which have impacted their bottom lines and potential to increase capital fund-raising in the West. The time for a new era has begun. The announcement of the Beijing Stock Exchange will usher in a fresh movement for Chinese SMEs to return back to their homeland to get publicly-listed on stock exchanges in Hong Kong, Shanghai, Shenzhen and soon to be – Beijing.

There’s no turning the tide. The Beijing Stock Exchange can generate more wealth for China’s SMEs. Consequently, other companies will express an interest in joining the ‘Third New Board’ and that will boost trading activities and market capitalization for the bourse.

The article reflects the author’s opinions, and not necessarily the views of China Focus.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +