Busting the Myth of Foxconn’s Recent “Return” to Henan

Foxconn’s future headquarters in Zhengzhou will primarily focus on four sectors: electric vehicles (EVs), battery energy storage systems, digital health and robotics.

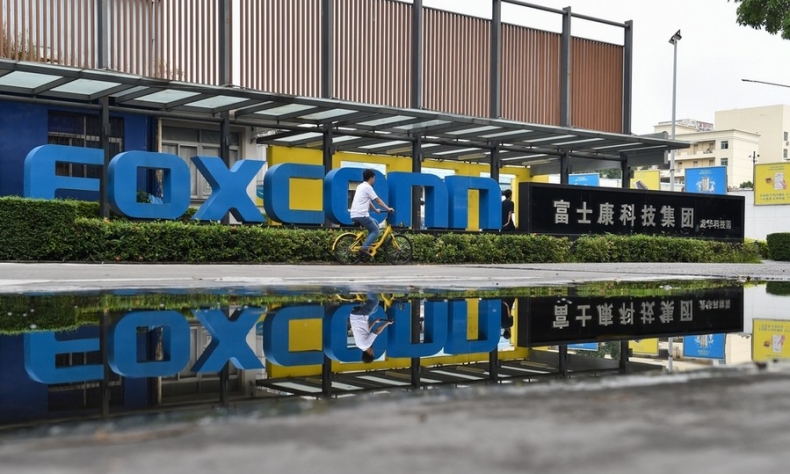

With Apple Inc. gearing up for the annual release of its latest iPhone on September 10, Foxconn, the world’s largest contract electronics manufacturer and largest assembler of iPhones, found itself headed into peak production season and in a frenzied hunt to find staff for the world’s biggest iPhone factory, located in Zhengzhou, capital of central China’s Henan Province.

Under the title “Foxconn Is Hiring,” job posts published by local recruitment agencies have flooded the Internet, promising potential employees a 25-yuan ($3.44) hourly rate and a bonus of up to 7,500 yuan ($1,053) for those who have worked for a full three months.

Within just two weeks of its release, the offer had helped Foxconn secure at least 50,000 new hires for its Zhengzhou factory, according to Ifeng.com, a Beijing-based news portal.

The hiring spree came on the heels of a new agreement reached on July 23 between Foxconn and Henan, under which the company plans to invest 1 billion yuan ($138.5 million) in the construction of new headquarters in Zhengzhou.

For years, stories about Foxconn leaving the country have been circulating wildly on Chinese social media. With the massive recruitment drive and new headquarters to be constructed in Zhengzhou, Chinese netizens are applauding the major comeback of the company in Henan. On short video platform Douyin, the Chinese version of TikTok, the hashtag “Foxconn returns” had amassed over 2 million views at the time of writing.

While the cheering continues, people seem to have overlooked one simple fact: Foxconn has never left Henan, or the Chinese mainland.

A sweet symbiosis

Zhengzhou’s love affair with Apple and Foxconn goes back to 2010, the year in which Foxconn relocated its major production base from the southern metropolis of Shenzhen to Zhengzhou in search of cheaper labor.

The city enthusiastically courted Foxconn by offering a $250-million loan, promised discounted energy and logistics costs, and even created a special bonded zone close to its airport, where customs duties and taxes were eliminated to facilitate the import of iPhone components.

In only five years, what used to be a jujube farm locked away in central China was transformed into a sprawling industrial complex connected to the entire world. Between 2010 and 2016, the factory assembled over 460 million smartphones, which made up 40 to 50 percent of the world’s total.

And now, the city has come to be known worldwide as the “iPhone City,” where an intricate network of suppliers, factories and hundreds of thousands of Foxconn employees manufacture about half of the world’s iPhones.

The evolution of Foxconn’s Zhengzhou factory was part of a wider trend that saw Apple’s fortunes become tied to China in a way that cannot be easily unwound.

“Apple would not be the company that it is today without China as a manufacturing base,” Eli Friedman, a professor of labor and development in China at Cornell University, told CNN, adding that the company, though headquartered in the United States, is “in some ways as much a Chinese company as it is an American company.”

Over the years, China has risen to become a backbone for Apple’s vast global supply chain. More than 95 percent of iPhones, AirPods, Macs and iPads were being made in China, an article in British daily newspaper Financial Times reported in 2013.

At the same time, Apple has greatly advanced Chinese suppliers’ understanding of cutting-edge electronics manufacturing. As the only country that has all the categories listed in the UN’s industrial classification, China now sports a level of technical sophistication that many industry insiders say they struggle to even comprehend.

What China offers is not simply labor, but an entire ecosystem of processes, built over many years, Jay Goldberg, founder of tech consultancy D/D Advisors, told Financial Times.

Staying put

However, recent economic and geopolitical shifts underscore how this symbiotic relationship, once considered a strength, has turned into a liability. Over the past few years, surging costs and growing frictions between China and the U.S. has forced Apple to adjust its China-centered supply chain strategy.

According to data published by the National Bureau of Statistics, the average annual wage in China has more than doubled over the last decade, rising from about 30,000 yuan ($4,211) in 2013 to over 65,000 yuan in 2022 ($9,123).

Meanwhile, Apple has been under intense pressure from American politicians and investors to decouple from China. In response, Foxconn began shifting a small percentage of its production to India and Viet Nam—countries that offer a unique mix of cheap labor and tempting policies. In 2017, to much local fanfare, the company began making new iPhone 14 in India, where previously only older models were made. By 2025, two thirds of the world’s AirPod earphones will be made in Viet Nam, JPMorganChase forecasted.

For Song Xiangqing, Vice President of the Academy of Government at Beijing Normal University, this strategic shift does not mean that Foxconn is unwinding from China. “It is all part of the diversification strategy of Foxconn as a global enterprise. Its goal is to maximize production capacity by spreading workforce across the globe,” Song told Beijing Review.

However, while India has a massive labor force, its relatively poor infrastructure, with bad roads and an unreliable electrical grid, is holding the country back. Viet Nam, on the other hand, faces a severe shortage of land and also has a significantly smaller population, 98 million, compared to China and India, whose populations both surpass 1.4 billion.

Foxconn is one of many companies that have unsuccessfully attempted to reduce its reliance on Chinese suppliers. Having discovered that few factories outside China have the machinery or the skilled workforce to meet their demands, many U.S. firms have returned at least a portion of their production to China, a 2023 Bloomberg article said.

“China possesses a range of competitive edges that just can’t be replicated in other countries,” Song said. This includes world-class infrastructure that is already in place at scale; a sprawling domestic market; a massive workforce with specialized skill sets; a set of highly integrated industrial chains; and an optimal business climate protected by supportive incentives and laws.

A second spring

Besides rediscovering China’s strengths in traditional labor-intensive manufacturing, companies worldwide are also shifting their focus within the country from low-end production to hi-tech industries.

Foxconn, once again, is a member of this league. This time, however, Apple is out of the picture. Under the new strategic partnership between Foxconn and the Henan Provincial Government, the company’s future headquarters in Zhengzhou will primarily focus on four sectors: electric vehicles (EVs), battery energy storage systems, digital health and robotics.

“These new areas of focus are at once a vote of confidence in the Chinese market and an indicator of change in the country’s investment scene,” Song said.

The new partnership also shows an interesting reversal: With a net profit margin that remains below 3.5 percent over the past decade, Foxconn hopes to leverage the deal to move itself up the global value chain. On the other end of the bargain, Zhengzhou, through multiple rounds of industrial upgrade, has risen to become one of the top 10 Chinese cities in the field of EV production.

The day after the new deal was signed, construction work began on a Foxconn EV plant near its old compound in Zhengzhou. Right now it is still a dusty peanut field. Yet hopes are high that this barren campus will grow into a new manufacturing powerhouse, just as the old Zhengzhou iPhone factory did a decade ago.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +