Meeting Expectations

China’s first-half economic growth remains stable amid headwinds

As it released data on China’s economic performance in the first half (H1) of 2019 on July 15, the National Bureau of Statistics (NBS) suggested that a solid foundation has been laid for the country to achieve its annual growth targets as the economy maintained steady, resilient development.

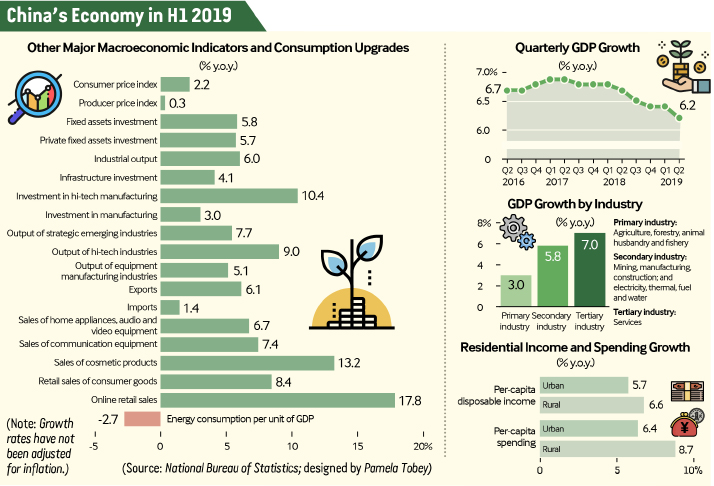

The GDP in H1 grew 6.3 percent year on year to about 45.09 trillion yuan ($6.55 trillion), meeting the annual target range of 6-6.5 percent set by policymakers. In the second quarter (Q2), it rose 6.2 percent year on year, slowing from 6.4 percent in the first quarter (Q1).

The Chinese economy has performed within an appropriate range despite global economic slowdown and domestic downward pressure. Instead of resorting to massive stimulus packages, the country has promoted reform and innovation, improved the domestic business environment and cut taxes and fees to boost the economy, NBS spokesperson Mao Shengyong told a press conference on July 15.

Wang Jun, a senior economist at the China Center for International Economic Exchanges, attributed the slowdown in GDP increase to China’s efforts to shift to higher-quality growth through economic restructuring. Despite the moderate growth, China had stable performances in employment and residents’ income and saw rebounds in indicators such as social financing, he said at the Guoshi Forum in Beijing on July 15. Hosted by China News Service, the event focused on China’s economic growth.

Driving Forces

Consumption, export and investment—known as the troika of China’s growth drivers—maintained steady growth in H1, with consumption continuing to play a key role by contributing 60.1 percent of overall growth. Consumer inflation also remained stable as the consumer price index rose 2.2 percent year on year, below the annual control target of about 3 percent, NBS data showed.

Total retail sales of consumer goods, a gauge of consumption, exceeded 19.5 trillion yuan ($2.8 trillion) in H1, up 8.4 percent from a year earlier. Notably, retail sales rose 9.8 percent year on year in June, up from 8.6 percent in May.

According to Wang, the consumer market was greatly boosted by rebounding car sales in June due to enhanced promotion by carmakers and dealers before new emission standards took effect on July 1.

About 2.06 million cars were sold in June, up 7.5 percent compared to May. Data released by the China Association of Automobile Manufacturers on July 10 showed that sales of new-energy vehicles (NEVs) rose 49.6 percent in H1.

Housing sales maintained stable growth in the January-June period as China continues to curb speculation and cool off the overheated property market. According to NBS data, commercial housing sales measured by floor area reached 757.86 million square meters in the six months, down 1.8 percent year on year.

Despite external uncertainties, half-year exports and imports of goods with major trading partners increased, with exports climbing 6.1 percent year on year to 8 trillion yuan ($1.2 trillion) and imports increasing 1.4 percent to 6.7 trillion yuan ($974 billion). The total value of imports and exports of private enterprises expanded 11 percent, representing 41.7 percent of overall foreign trade.

Members of the Association of Southeast Asian Nations, European Union states and countries participating in the Belt and Road Initiative contributed the most to the growth of China’s foreign trade, Bai Ming, Deputy Director of the International Market Research Institute, said at the Guoshi Forum.

China’s trade with Belt and Road participants totaled 4.24 trillion yuan ($617.5 billion) in H1, increasing 9.7 percent year on year, according to the General Administration of Customs of China (GACC).

To further boost foreign trade, China needs to enhance manufacturing industries to gain more of an edge in exports and broaden its market access to better meet domestic demands and participate in the global industrial chain, Bai stressed.

On July 10, the State Council, China’s cabinet, decided to launch an array of new policies to expand foreign trade with the focus on improving fiscal and tax policies. The reforms will further lower the overall import tariff level, refine export tax rebate policies and speed up the tax rebate process.

Notably, investment in the January-June period saw differentiated performances. According to NBS data, investment in the primary industry went down 0.6 percent year on year, while that in secondary and tertiary industries climbed 2.9 percent and 7.4 percent, respectively.

Investment in hi-tech manufacturing and services rose 10.4 percent and 13.5 percent, respectively, year on year, both higher than that of total investment.

However, infrastructure spending and investment performance by private sectors were not up to expectations. Fixed assets investment climbed 5.8 percent in H1, down from 6.3 percent in Q1, while real estate investment increased 10.9 percent year on year in H1, slower than the 11.2-percent increase in the first five months. Private investment in H1 gained only a 5.7-percent year-on-year increase.

“Since the decelerated GDP growth in Q2 can be partly attributed to the aforementioned decline, more efforts are needed to ratchet up total investment,” Xu Hongcai, Deputy Director of the Economic Policy Commission, China Association of Policy Science, told Beijing Review.

Higher Quality

As China shifts its focus to high-quality growth from high-speed development, a high growth rate no longer indicates economic resilience. According to Wang, the efforts to promote economic restructuring in H1 have seen remarkable payoffs.

The industrial output expanded 6 percent year on year in H1. In June alone, industrial output growth accelerated to 6.3 percent from 5 percent in May. Although the profit of major industrial firms fell 2.3 percent year on year in the January-May period, the decline narrowed 1.1 percentage points from the first four months of the year.

Emerging industries of strategic importance and hi-tech manufacturing industries stood out in the H1 economic performance. The value added of strategic emerging industries secured an increase of 7.7 percent year on year, while the value added of hi-tech manufacturing industries rose 9 percent year on year, 1.7 and 3 percentage points higher than that of all major industrial enterprises, respectively.

Although car sales saw fluctuating growth in H1, rising NEV demand is still driving the auto industry as China pushes ahead to green development. According to NBS data, the output of NEVs and solar cells surged 34.6 percent and 20.1 percent, respectively, year on year.

The service industry also maintained a sound growth momentum. NBS data showed that the service sector output in H1 accounted for 54.9 percent of total GDP, rising 7 percent and outpacing the 3-percent and 5.8-percent increases in the primary and secondary industries, respectively.

The value added of information transmission, software and information technology services, leasing and business services, transportation, warehousing and postal services all saw remarkable expansion. Consumption of services represented 49.4 percent of final consumption growth in H1, up 0.6 percentage points from the previous year.

According to Lai Youwei, Deputy CEO of Meituan, China’s largest on-demand online service provider, rising online consumption of services and newly emerging service demand, such as home-sharing and cosmetology, have injected strong impetus into the economy. To maintain the growth momentum of these industries, he said the government should further improve the business environment and provide more supporting policies.

In addition to industrial upgrading, improving people’s income is also significant to the pursuit of high-quality economic growth, Wang said. He called for more targeted employment-boosting policies for middle- and low-income groups.

China’s job market experienced stable development as another 7.37 million people in urban areas were employed, accounting for 67 percent of the annual target. The per-capita disposable income stood at 15,294 yuan ($2,227), up 8.8 percent year on year in nominal terms. The inflation-adjusted growth was 6.5 percent, NBS data showed.

Support and Stimulus

To cope with downward pressure and boost the domestic market, China has implemented a string of fiscal and monetary policies as it seeks stronger market confidence and more tangible benefits for enterprises and individuals. According to the 2019 Report on the Work of the Government released in March, the tax burden and social insurance contributions of enterprises will be cut by nearly 2 trillion yuan ($291.12 billion) this year, in line with a proactive fiscal policy.

In the first five months of the year, newly introduced tax cuts and fee reductions saved businesses about 893 billion yuan ($129.8 billion), data from the State Taxation Administration showed.

In June, new policies were introduced to encourage local government special bond issuance to fund eligible major projects and bolster infrastructure growth.

According to Zhang Xuedan, a researcher with the Chinese Academy of Fiscal Sciences, the tax cuts and fee reductions have shown positive results in boosting the economy. To make the policy sustainable, he said the government needs to improve transfer payments to impoverished areas to ensure local fiscal revenue.

In addition, to provide financing support for the real economy, the People’s Bank of China, the central bank, lowered the reserve requirement ratio (RRR) for small and medium-sized commercial banks in May, which is expected to release 280 billion yuan ($40.7 billion) of long-term liquidity. The freed fund will be used for providing more loans to private as well as micro and small companies, the bank said in a statement.

Against mounting external challenges, China has announced measures to improve the domestic business environment and open up more sectors for foreign investment. In the latest move to widen opening up, it unveiled new negative lists for foreign investment market access on June 30, further cutting off-limit items.

While boosting domestic market expectations, the move may also trigger risks, which calls for precautions, Tan Yaling, Dean of the China Foreign Investment Research Institute, told the Guoshi Forum. “The country needs to improve management of foreign investment and enhance the competitiveness of domestic market players,” she said.

Future Outlook

According to GACC, China had a 45-percent year-on-year growth in trade surplus at 5.5 trillion yuan ($799 billion) in the first five months.

The economy will still face great downward pressure while the trade surplus is likely to narrow in H2, Xu warned.

Although Wang has an upbeat view about the economic performance in the remaining months of the year, he stressed that China needs to further cut overcapacity, strengthen high-end manufacturing and translate technologies such as 5G into products to avoid bubbles in hi-tech industries.

According to Mao, the effects of the counter-cyclical adjustment policies such as tax and RRR cuts to boost the economy will become more prominent in H2.

“With ample economic policy tools at its disposal and the expanding domestic consumer market, China’s economic growth will remain stable in H2,” Mao said.

“Although China’s GDP growth rate may decline to 6.1 percent in the fourth quarter, the figure for this year is expected to fall between 6.2 and 6.3 percent which still meets the annual target,” Xu said, adding that encouraging private investment and boosting consumption will remain priority tasks.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +