Modern Semiconductors: From Restrictions to Resilience

Political pressure and confrontation tactics have proven ineffective, as intense competition ultimately benefits consumers.

On August 29 last year, Chinese tech titan Huawei’s Mate 60 Pro Android phone hit the market and American tech experts were quick to dissect it to understand its inner workings.

They soon discovered that the company had crafted an innovative device that supports 5G wireless network technology despite facing harsh restrictions in the United States that nearly decimated its smartphone business a few years ago.

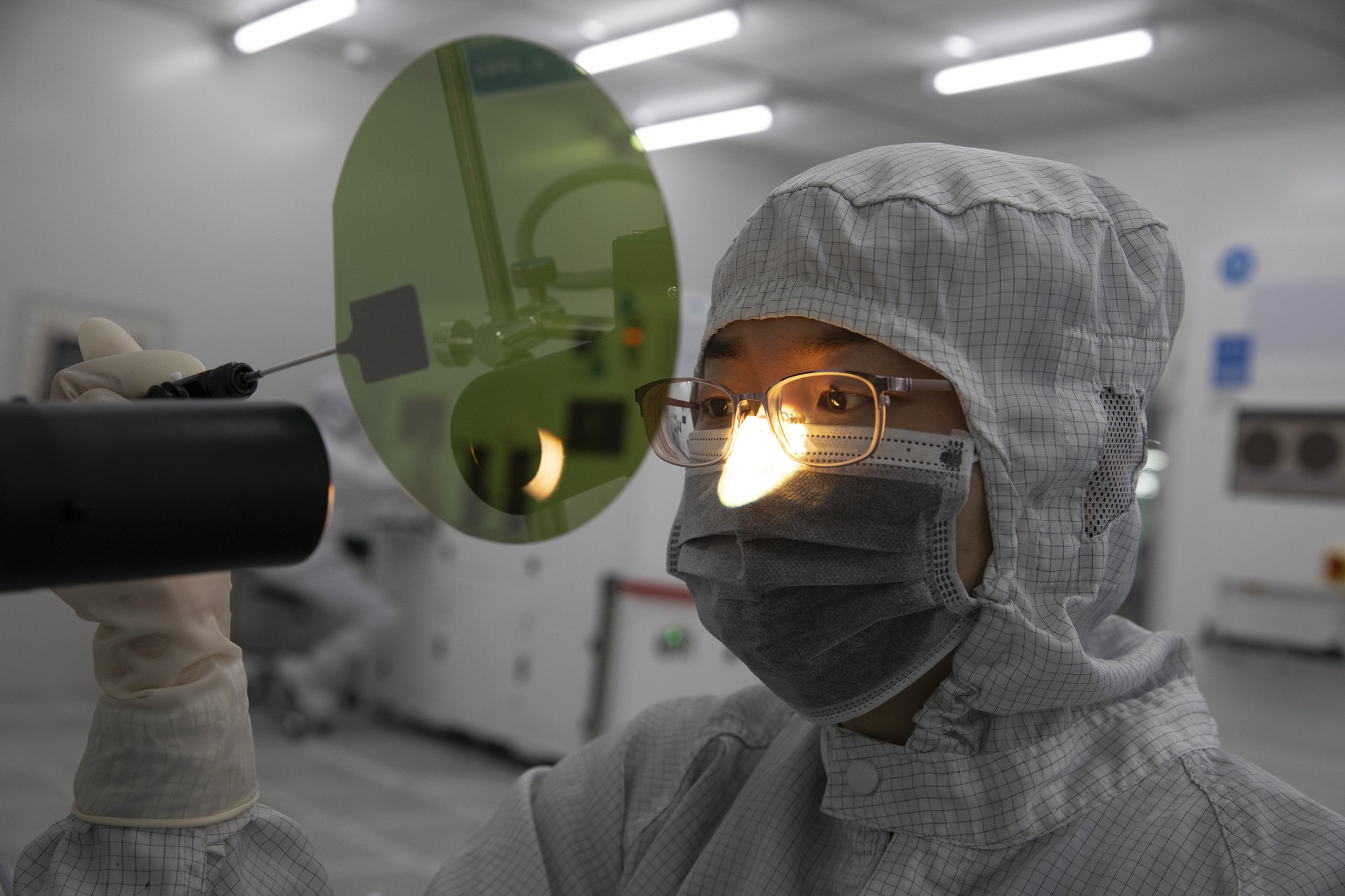

Upon examining the phone’s components, engineers found that it was powered by a 7-nanometer (nm) chip manufactured by Chinese chipmaker Semiconductor Manufacturing International Co. (SMIC). This was not just a technological feat by Chinese engineers but a testament to the industry’s resilience and innovation. It left American engineers, and politicians, in awe.

In February, international media once again reported significant breakthroughs in China’s semiconductor technology development. SMIC had successfully established new production lines capable of manufacturing 5-nm chips. These numbers—5 nm and 7 nm, signify the processor size or, in other words, the distance between a chip’s transistors. The smaller the size, the higher the transistor density and the better the performance and energy efficiency.

This milestone not only showcased SMIC’s ability to compete with other industry giants but also had the potential to reshape the global semiconductor landscape. The production of 5-nm chips was expected to considerably enhance the performance of many critical components, potentially bridging the gap between Chinese artificial intelligence chips and U.S. tech company Nvidia’s cutting-edge graphics processing units (or the units in a device that help manage graphics-related work like effects and videos—Ed.). This development could alter the dynamics of the global semiconductor market, sparking curiosity about the industry’s future.

Launching into lithography

In 2019, the U.S. Government initiated a technology war against Beijing, which had far-reaching implications for Huawei and other Chinese tech companies. It was followed in 2022 by a ban on selling advanced semiconductors and chip-making equipment to Chinese companies, further tightening existing restrictions.

The U.S. has pressured the Netherlands and Japan to limit China’s access to advanced chip-making equipment. While there were discussions and some measures taken by these countries, the extent and impact of such actions varied. Yet they are a stark reminder of the intricate and dynamic nature of the global technology landscape, with geopolitical tensions exerting an immediate influence on the future of semiconductor and chip-making technologies, underscoring the topic’s relevance.

When Huawei launched its Mate 60 Pro smartphone with a domestically produced 7-nm chip, U.S. Secretary of Commerce Gina Raimondo reassured Congress members that SMIC could not yet produce those chips on a large scale.

Many Western analysts also expressed doubts about the commercial viability of SMIC’s 7-nm process.

They were skeptical of SMIC’s ability to produce advanced chips in large volumes due to their own inability to use the latest chip manufacturing equipment with extreme ultraviolet (EUV) lithography technology, a cost-effective method to create more advanced integrated circuits.

But their assumptions were proved incorrect.

From August 2023 to January, Huawei sold 30 million of its Mate 60 Pro phones with Kirin 9000s 7-nm chips and plans to sell around 100 million in 2024. Kirin is a series of mobile electronic integrated circuits manufactured by HiSilicon Technologies, a subsidiary of Huawei.

Lithography plays an essential role in producing the chips. Such equipment constitutes about one third of the chip manufacturing equipment market, valued at approximately $100 billion. Dutch company ASML, a major chipmaking equipment vendor, holds over 90 percent of the global market share. It is also the only manufacturer of the latest EUV lithography equipment, vital for producing sub-10-nm chips. Due to sanctions, China lacks access to this technology.

Chinese engineers accomplished their breakthrough by making those chips on earlier deep ultraviolet (DUV) lithography machines.

China is presently prioritizing the advancement of its lithographic technology. Last August, Shanghai Micro Electronics Equipment Group announced it would start manufacturing lithography equipment using the 28-nm process. This is a big improvement, as the country’s capabilities in this field until recently were limited to 90-nm machines.

Moving on

U.S. President Joe Biden recently announced plans to establish advanced semiconductor production in the U.S. He argued that while the U.S. accounts for 25 percent of the global semiconductor demand, its manufacturing capacity is only 12 percent, down from 37 percent in the 1990s.

However, industry experts doubt the success of this undertaking.

Morris Chang, former Chairman and CEO of Taiwan Semiconductor Manufacturing Co., which produces 90 percent of the world’s most advanced chips, estimated that modern chip production in the U.S. would cost 50 percent more than in China’s Taiwan Province due to labor costs and a lack of professionally trained personnel. The U.S. semiconductor industry has been grappling with rising costs and skilled labor shortages for years.

Deep concerns exist even within the U.S. Government about a risky move, and officials are quietly abandoning a crucial incentive for semiconductor research and development. “The CHIPS Program Office has decided not to move forward at this time with the Notice of Funding Opportunity for the construction, modernization or expansion of semiconductor research and development facilities in the U.S.” This statement, hidden deep within one of the Department of Commerce agencies’ websites, contradicted Biden’s stance.

The global semiconductor industry boasts annual sales of $600 billion and that figure is expected to double over the next six to eight years. The recent semiconductor and chip-making tech supply chain challenges have made it clear that containing the spread of advanced technologies is becoming increasingly difficult.

China’s semiconductor industry is rapidly evolving and has reached a high level of sophistication. Although market fragmentation and growing competition might temporarily impact production inefficiency, the outcome will be improved product quality.

Political pressure and confrontation tactics have proven ineffective, as intense competition ultimately benefits consumers.

The author is former prime minister of Kyrgyzstan, professor at the Belt and Road School of Beijing Normal University and author of Central Asia’s Economic Rebirth in the Shadow of the New Great Game.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +