More Policy Tools to be Deployed to Keep Economy Rebound in 2024

The economic work for 2024 focuses on stable progress, making further economic growth through stabilization.

The recent Central Economic Conference on December 11-12 endorsed China’s economic performance in 2023 as solidly maintaining an upward growth trend, with new breakthroughs in technology innovation and further deepening in reform and opening-up.

The first three quarters of 2023 registered 5.2 percent GDP growth over a year ago. As Q4 2022 was a low base, with only 2.9 percent GDP growth y-o-y, there is little doubt that GDP growth rate during the last quarter of 2023 will easily break 5 percent, thus making the whole year GDP above 5.0 percent, hitting the goal set at National People’s Congress early this year. Both IMF and OECD had revised upward estimate on China’s GDP growth to 5.4 percent for 2023. After three years of the pandemic drag, China will again contribute approximately 30 percent to world economic growth this year. 2023 is the first year after the 20th National Congress of the Communist Party of China, and the first year in the march towards a medium developed economy in 2035.

On the other hand, the economic performance over the past year has not hit a new surge. Rather, it is still experiencing an inadequate demand, overproduction in certain areas and low anticipation. Consumption, while contributing over 90 percent to GDP growth during Q3, is not back to the trend level. While total retail sales grew 7.6 percent in October y-o-y, it was compared to a very low base in October 2022 when it fell 0.5 percent over October 2021, making the two-year annual average growth of only 3.5 percent. Total added value of above-scale industry grew by 4.6 percent y-o-y which looks OK. However, most of the growth came from traditional sectors, including iron and steel, non-ferrous metals and chemicals, and the high-tech sector registered a meagre 1.9 percent growth y-o-y. Industry capacity utilization rate was only 75.6 percent during Q3, 2023, compared to 78.9 percent in the United States. Both import and export growth, in U.S. dollar terms, were all in the negative till November.

The PMI in manufacturing sector remains under 50, or in contraction area, for each month since July except September when it barely hit 50.2. The new export order PMI were all under 47 (except September at 47.8), well in the area of contraction. Both CPI and PPI accelerated their fall in November, by 0.5 percent and 3.0 percent respectively, reflecting the continuous inadequate demand.

The economic work for 2024 focuses on stable progress, making further economic growth through stabilization. For this purpose, more policies will be launched to stabilize the economic anticipation, growth and job creation. They include, among others:

First, expansion of domestic demand. The consumption recovery and expansion are on a high priority. Efforts will be made to increase people’s income through different channels, to support their living conditions improvement, new energy vehicles consumption and aged catering services.

Second, mobilization of social investment through government investment and policy incentives, encouraging more private capital in key national projects.

Thirdly, the continuation of proactive fiscal policy and stable monetary policy and enhance macro-economic readjustment and coordination to support the high-quality development.

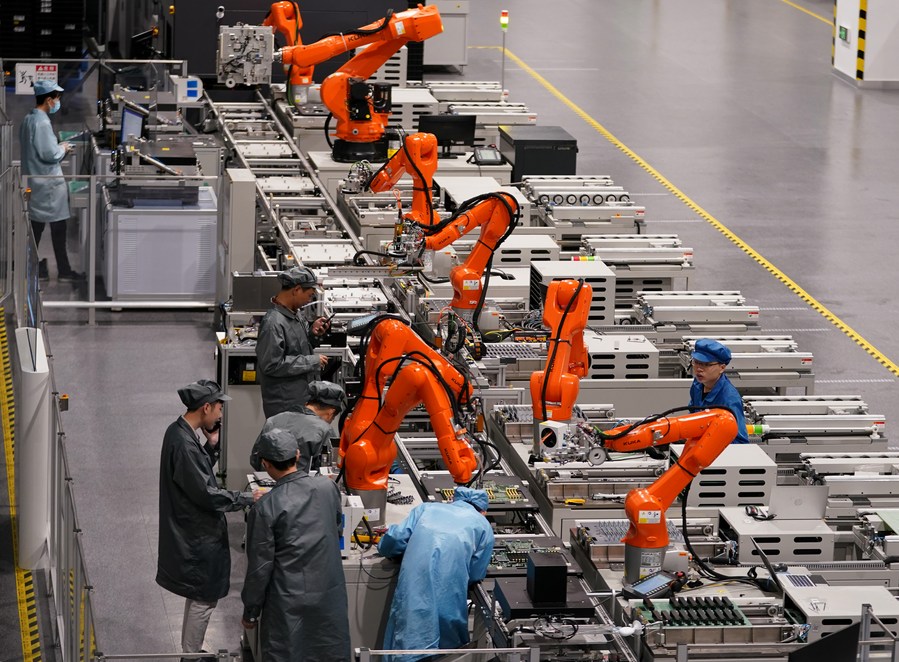

Fourth, greater emphasis on upgrading the traditional industries and expanding the strategic new emerging industries.

Fifth, higher priority on youth employment, especially the employment of college graduates.

Sixth, a new round of 50 million tons grain output increase and acceleration of development and application in new energy, AI, bio-manufacturing, green and low carbon and quantum computing.

The policies also call for firm support to the private economy, deepening market-oriented reforms and further encouragement of foreign direct investment.

The fiscal policy tools, in particular, will play a key role. There will be more fiscal policy support to the economy. Over the past year, the central government has issued a 1-trillion-yuan special bond to relieve the local governments’ debt burden. It is estimated that more transfer payments will be deployed from the central to the local governments, supporting local economic growth. More fiscal spending is also expected to support key investment projects to accelerate the growth. The fiscal deficit rate was around 3.8 percent in 2023, and will probably hit 4 percent or a little higher in 2024. It is by no means a big problem. Rather, it is the common practice in many countries. In the U.S. and European countries, governments tend to expand fiscal spending for macro-economic readjustment, so as to accelerate the economic rebound. When the economic growth returns to the trend line, the fiscal deficits also fall. It is expected that more active fiscal resources will be deployed for three purposes: the improvement of people’s livelihood, especially to those in difficulties; research and development in new technologies supporting the high-quality development; and alleviation of local government difficulties.

The monetary policy will be more targeted to the actual need of the economy. It will help stabilize the property market which has been a drag on the whole economy over 2023.

The high-level opening up will also play a key role in Chinese economy in 2024. The past year has witnessed a fall in China’s import and export trade, and especially FDI inflow. For the first 10 months, China’s total FDI inflow was 987 billion yuan, 9.4 percent off a year ago. FDI inflow in October fell to 67 billion yuan, or under $10 billion, the lowest level in a decade. The world geoeconomic fragmentation has posed a severe challenge in China’s external environment, and in turn, increased China’s domestic economic difficulties. The only correct policy in response, as pointed out by the 2023 Central Economic Conference, is further expansion of high-level opening up, offering more market access to foreign investors, especially in service sectors, and guaranteeing an open, fair, non-discriminative treatment to all players in China, including SOEs, private or foreign. Only in this way, can China support a continuous economic recovery and growth, and fit fast in the global supply chain.

The article reflects the author’s opinions, and not necessarily the views of China Focus.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +