New Quality, Great Potential

With its focus on high-quality development, China remains a stable and profitable market for foreign investors.

Here are some of the achievements China made in 2023: GDP exceeded 126 trillion yuan ($17.43 trillion) with a growth of 5.2 percent; 12.44 million new urban jobs were created; average surveyed unemployment rate in urban areas was 5.2 percent; consumer price index increased by 0.2 percent; new energy vehicle production and sales accounted for more than 60 percent of the global share; grain output reached a record high of 695 billion kg; installed renewable energy capacity surpassed thermal power capacity for the first time in history, and China accounted for over half of newly installed renewable energy capacity worldwide; per-capita disposable income of residents increased by 6.1 percent …

These figures from the Report on the Work of the Government presented during China’s Two Sessions in 2024 shows that China’s economy has delivered brilliant results in the past year, despite many risks and challenges such as the continued impact of the COVID-19 epidemic, the volatile international situation, and frequent extreme climate disturbances. The achievements once again demonstrate to the world that China’s economy has firm confidence, strong resilience, strong momentum and bright prospects.

External scepticism

Needless to say, these achievements were not easy. Looking at the external environment, 2023 was one of the years when the world economy saw relatively weak growth. Under the pressure of the global wave of radical interest rate hikes led by the US Federal Reserve System, China’s foreign trade, which had performed well during the three-year pandemic, is facing the grim reality of shrinking foreign demand and declining growth rate.

Geopolitical crises are another factor. The Ukraine crisis is in its third year and the conflict between Palestine and Israel has suddenly intensified. These crises have deepened international divisions and strengthened the blocs in the world economic system. The US holds high the banner of “out-competing China” and continues to erect industrial “high walls” to accelerate the “de-risking” in the supply chain.

Domestically, the pace of consumption recovery has been slower than expected, while the real estate industry continues to undergo profound adjustments. These issues are also combined with heightened concerns regarding local debt and the risk exposure of small and medium-sized financial institutions. Under such circumstances, there has been considerable scepticism worldwide regarding China’s economic growth prospects. Some Western media and institutions have made false claims about the economy, such as “stimulus policies are not effective” and “business environment deteriorating.” Such narratives, in conjunction with the policies and propositions of “de-risking,” “countering economic coercion” and “promoting collective economic security” promoted by the US and European governments, set off a wave of doubts and divestments in China’s economy. Their attempt is to block the inflow of foreign capital into China, undermine the international confidence in China’s economy, and suppress China’s development momentum.

China has not shied away from these risks and challenges. The Report on the Work of the Government made it clear that China’s economy was faced with an array of interwoven difficulties and challenges. The Chinese government has made efforts in six aspects, that is, strengthening macro regulation, promoting industrial upgrading through innovation, deepening reform and opening up, accelerating the transition to a model of green development, ensuring public well-being, and working to improve government performance across the board. China withstood external pressure, overcame internal difficulties and accomplished the main goals and tasks for economic and social development in 2023. China’s economy has contributed one-third of the world’s economic growth, fulfilling its due responsibilities as the world’s second-largest economy, and continuing to be the main engine of global growth.

Numbers are important for observing China’s economy, but what’s more important is to realise the deep-rooted changes in China’s economic fundamentals and development principle behind the numbers. The current negative rhetoric on China’s economy is based on the mere comparison of present and past growth rates, or the selective extraction of certain data, thereby exaggerating the short-term fluctuations and current difficulties faced by China’s economy and drawing a pessimistic conclusion. This is essentially a repackaging of clichés such as the “China collapse” that have been repeatedly hyped over the past few decades.

The fallacy of this kind of argument is as follows.

First, it reflects the paranoia of sticking to the outdated theory of “Washington Consensus” when it is no longer the appropriate “yardstick” to judge China. Over the past 40 years of reform and opening up, China’s economy has been upgraded tremendously and has grown into a large-scale economy with the largest middle class and the most complete industrial system in the world. It has embarked on a modernisation path with Chinese characteristics, which is difficult for Western scholars to accept and explain.

Second, it demonstrates shortsightedness and limited way of thinking. Unlike the US economy, which has pursued post-pandemic recovery through substantial monetary and fiscal stimulus measures, China has opted for a more restrained approach to macroeconomic control. It emphasises coordinated efforts to stabilise growth while enhancing sustainability and refraining from adopting a deluge of strong stimulus policies. Instead, China is directing its efforts towards promoting high-quality development.

According to the Report on the Work of the Government, this development principle can be summarised as “giving priority to consolidating the foundations of the economy,” reflecting China’s responsible attitude and long-term vision towards economic development, people’s well-being and even global economic stability. The “beggar-thy-neighbour” monetary policies of the US and Europe have dragged the world into the quagmire of high inflation. If China follows suit, it is likely that more developing countries will fall into economic and social crises caused by high inflation.

Third, it shows the malicious intention of confusing right with wrong. The political game between China and the US has promoted the so-called “conflict of values” and “national security anxiety,” and the ideological stances of economic development practices and models have gradually become more prominent. Under such “tinted glasses,” China’s improvement of domestic regulations is slandered as “deterioration of the business environment,” and China’s guidance on industry development is interpreted as “suppressing private enterprises.” At present, discrediting China’s economic growth prospects has become an exercise in political correctness.

New quality productive forces

Judging from the main targets for development this year listed in the Report on the Work of the Government, we can see that China’s economy will continue to grow at a medium-to-high pace in 2024, taking the path of high-quality development. In 2024, China will achieve a GDP growth of around 5 percent and create over 12 million new urban jobs. Any sceptical Western media would have to admit that this goal is ambitious. At the same time, with its fiscal deficit rate staying at 3 percent, China’s monetary policy remains prudent, which highlights the strategic determination and confidence of the Chinese government in its economic development strategy. It has not changed course due to external pressure.

Of course, we have seen China’s optimisation and innovation of economic tools, such as the ultra-long special treasury bonds; we have seen the government’s response to the demands of market entities, that is enhancing consistency in macro policy orientation and creating a stable, transparent, and predictable policy environment; and we have seen the deployment of the 10 major tasks for 2024 that aim to make precise efforts with focus on major issues of China’s economy and society.

The biggest highlight is undoubtedly the mention, for the first time, of the new quality productive forces in the report. Led by technological innovation, new quality productive forces are China’s response to the emerging wave of technological revolution and industrial transformation around the globe. The rapid development of the AI symbolised by ChatGPT and the acceleration of the global carbon neutrality trend are profoundly and rapidly reshaping the global industrial model and governance structure. The world economy is thus facing a significant shift in paradigm.

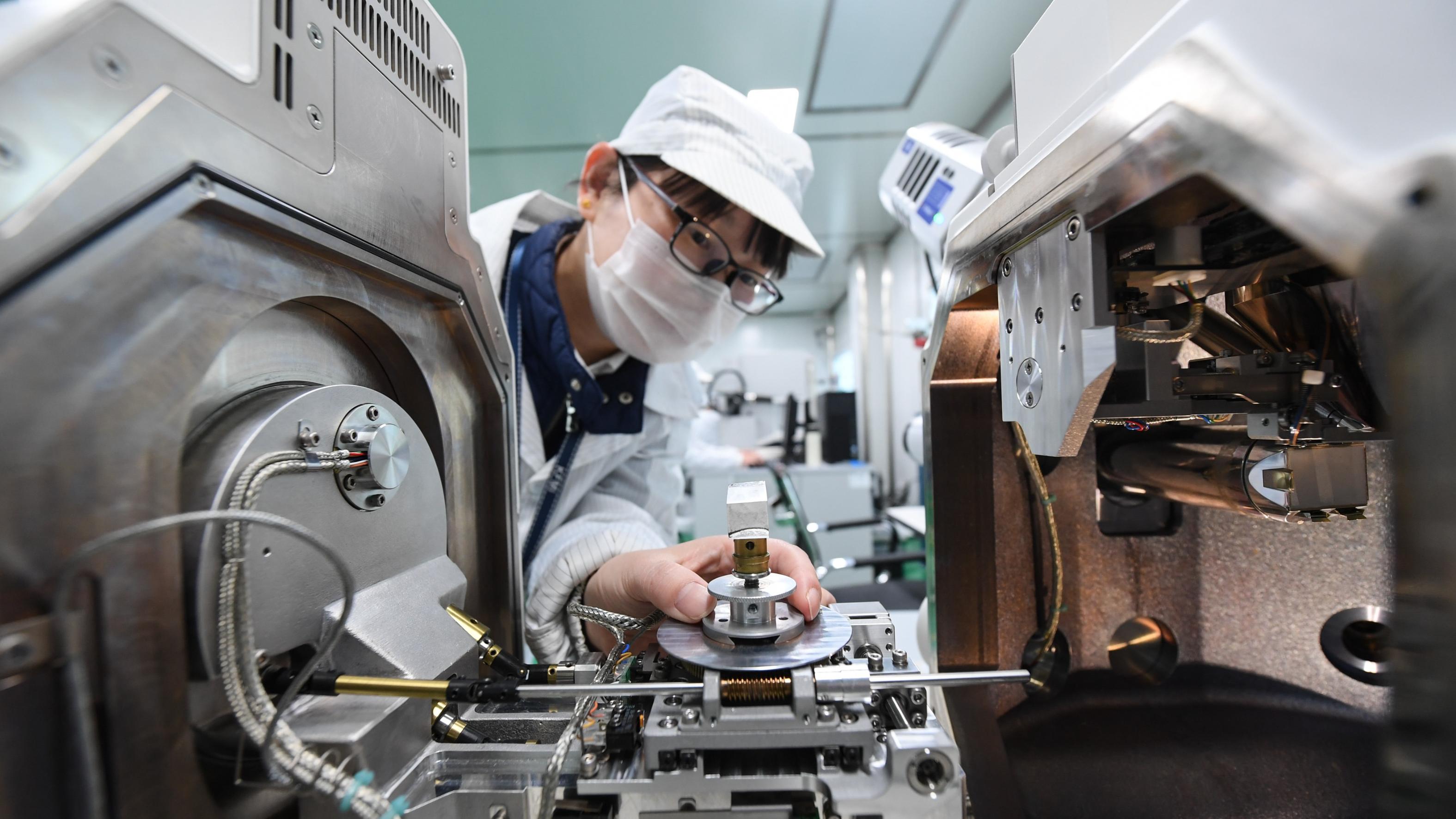

In the competition among countries, if a country can seize the opportunities brought by emerging industries, it will surely usher in a bright future. “Striving to modernise the industrial system and developing new quality productive forces at a faster pace” and “invigorating China through science and education and consolidating the foundations for high quality development” are the first two items of the major tasks for 2024. This contrasts with former practice of prioritising measures for stabilising the economy and promoting growth, which has unequivocally shown China’s emphasis on innovation in science, technology, and industry.

The vigorous development of emerging industries is profoundly altering the foundation of China’s economic growth, propelling its economy onto a high-quality development path characterised by intelligence, environmental protection, high efficiency, and a high input-output ratio. The electric vehicles, lithium-ion batteries and photovoltaic products are becoming new growth engines and stabilisers of China’s exports. Chip manufacturing is rapidly advancing, and the number of AI patent applications in China ranks first in the world. Additionally, sectors such as hydrogen energy, biopharmaceuticals, commercial aerospace, and the low-altitude economy are on the cusp of significant growth and expansion. A number of competitive companies are emerging.

Objectively speaking, the blockade and suppression of China’s science and technology fields and emerging industries by the US, Europe and other countries will undoubtedly create certain challenges. However, in a sense, it also serves as an “endorsement” of China’s competitiveness in such fields. At the end of 2023, the US Information Technology and Innovation Foundation asserted that China’s substantial efforts and investments in advanced technology in recent years are yielding results, positioning it as a global leader in key strategic industries such as computers and electronic products, chemicals, and motor vehicles. This advantageous position in the new round of technological and industrial competition instils ample confidence in China’s economy.

Bright prospects

China will continue to open its door wider. The emergence of China’s economic miracle is attributed not only to the hard work and perseverance of the Chinese people, but also to the infusion of external ideas, capital, and technology. Over the past four decades, amid the globalisation trend, China and foreign investors have achieved win-win results. China has emerged as a prime destination for foreign investment, benefitting from the recent wave of industrial shifts in the global supply chain.

Foreign investors have benefitted from China’s development, resulting in significant surplus income that ultimately benefits their home countries. Foreign capital plays an important role in China’s market entities and is also an important force driving China’s economic growth. However, it is undeniable that the West’s efforts to realign the global supply chain, coupled with the intensified competition resulting from China’s industrial upgrading, have prompted some foreign capital to gradually withdraw due to political or economic considerations. This has resulted in a situation where, although the actual amount of foreign capital utilised in 2023 remains high, it has decreased compared to previous years.

China has paid full attention to the need to attract foreign investment and has taken positive steps in this regard. In August 2023, the State Council issued the Opinions on Further Optimising the Foreign Investment Environment and Increasing Efforts to Attract Foreign Investment, which proposed 24 specific measures in six areas to actively respond to the concerns and demands of foreign businesses in China; in October 2023, at the third Belt and Road Forum for International Cooperation, Chinese President Xi Jinping announced that China will remove all restrictions on foreign investment access in the manufacturing sector, and will further advance high-standard opening up in cross-border service trade and investment to align with the international high-standard economic and trade rules. The Report on the Work of the Government once again proposed to further shorten the negative list for foreign investment, expand the catalogue of encouraged industries for foreign investment, and strengthen services for foreign investors.

As Foreign Minister Wang Yi put during the Two Sessions, China cannot be separated from the world economically, and the world also needs China for prosperity. China stands out with its peaceful and stable political and social environment. It boasts a super-scale single market of over 1.4 billion people, a significant demographic dividend, and a high-quality talent pool. Additionally, China maintains a high level of institutional openness.

Consequently, China undoubtedly offers greater certainty to risk-averse foreign investment and serves as the premier investment destination and “safe haven” for foreign companies seeking economic efficiency and cost advantages. In recent years, the rate of return on foreign direct investment in China has hovered around 9 percent, remaining relatively high on an international scale. Looking ahead, China’s economy, transitioning towards high-quality development, is poised to offer even greater development opportunities and investment returns to foreign investors.

What President Xi stated at the opening ceremony of first China International Import Expo in 2018 provided the most compelling affirmation of China’s economic prospects: “To use a metaphor, the Chinese economy is not a pond, but an ocean. The ocean may have its calm days, but big winds and storms are only to be expected. Without them, the ocean wouldn’t be what it is. Big winds and storms may upset a pond, but never an ocean. Having experienced numerous winds and storms, the ocean will still be there! It is the same for China. After going through 5,000 years of trials and tribulations, China is still here! Looking ahead, China will always be here!”

The author is Assistant Director of Institute of World Economics Studies, China Institutes of Contemporary International Relations.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +