Opening Wider

China removes foreign investment restrictions in more sectors

China unveiled its updated special administrative measures (negative lists) for foreign investment market access on June 30, further cutting off-limit items in its pursuit of further opening up. Jointly released by the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM), the two new lists will take effect on July 30.

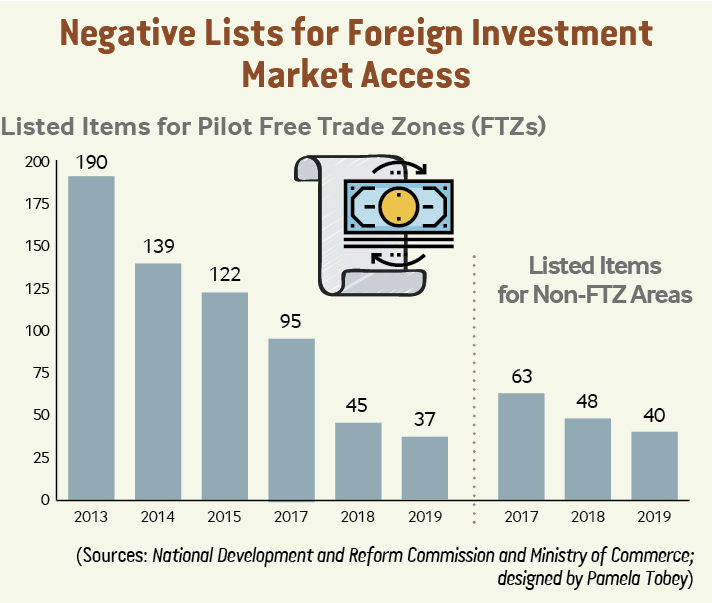

It is the fifth time that the negative lists have been revised over the past six years. Items restricting foreign investment on the list for pilot free trade zones (FTZs) that enjoy higher-level opening up have been cut from 45 to 37, while on the list for non-FTZ areas, items have been slashed from 48 to 40.

The reforms will expand the country’s market access and allow foreign investors to run majority-share or wholly-owned businesses in more sectors, the NDRC said.

Gao Feng, a spokesperson for MOFCOM, told a press conference that the new negative lists focus on easing restrictions in the service, agriculture, mining and manufacturing sectors and aim to make FTZs more open.

In addition, a new industry catalogue, which will go into effect on the same day as the new negative lists, was also released to encourage foreign investment in high-end, smart and green manufacturing. Sang Baichuan, a professor at the University of International Business and Economics in Beijing, said the revised catalogue is more consistent with the negative lists, making its role as a foreign investment booster further stand out.

“The new negative lists and catalogue emerged from China’s steady efforts at broadening its opening up, which can give the country more leverage when coping with global uncertainties and rising downward pressure on its economy,” Nie Pingxiang, a researcher with the Chinese Academy of International Trade and Economic Cooperation (CAITEC), told Beijing Review.

More Access

Negative lists for foreign investment market access specify sectors, fields and businesses closed or restricted to foreign investors. In recent years, China has steadily simplified the lists as it continuously drops more items, making them available to all market players.

The negative list approach started in China in 2013 in the Shanghai FTZ, which was later extended to other FTZs and then non-FTZ areas. Compared with previous versions, the 2019 lists significantly lift restrictions in the service sector. According to Nie, China has seen initial success in the opening up of its manufacturing sector, while access to the service sector needs to be further eased.

Data from the National Bureau of Statistics (NBS) showed that the service sector accounted for 52.2 percent of China’s GDP in 2018. Zhang Jianping, a researcher at CAITEC, suggested that the proportion has to improve, since the country’s service sector is still not competitive enough.

To better meet rising domestic demand and drive high-quality economic growth, China needs to speed up the improvement of the domestic service industry through widening market access, he said.

The new lists ease or remove restrictions on ownership in the service sector including shipping agencies, gas and heat pipelines in cities with more than 500,000 residents, cinemas and performance brokerage institutions, as well as investment limits on some value-added telecommunication services.

The restrictions that limit the exploration and development of petroleum and natural gas resources to Chinese-foreign equity joint ventures or non-equity joint ventures have been removed. The lists also lift bans on foreign investment in the development of wildlife and plant resources as well as the production of Xuan paper and ink ingots.

Particularly, the FTZ negative list further abolishes restrictions on foreign investment in areas such as aquatic products, fishing and publications.

“The opening up in key areas can further promote fair competition, improve the domestic business environment and create more room for China’s international cooperation,” Hao Hongmei, Deputy Director of the Foreign Investment Institute at CAITEC, told China Business Journal.

Allowing foreign investment in the energy industry, including oil and gas exploration can help narrow the gap between energy supply and demand in China and bring in more advanced exploration technologies, she said, adding that the energy sector will benefit from the move as long as appropriate regulations are in place.

As follow-up efforts, the NDRC vowed to eliminate all existing restrictions outside the negative lists before the end of the year at a press conference on June 17.

High-end Manufacturing

The catalogue of encouraged industries for foreign investment consists of a catalogue for boosting foreign investment nationwide and one of advantageous industries for foreign investment in China’s central, western and northeastern regions.

“The revision is in line with China’s demand for upgrading domestic industries and expanding international cooperation as the country shifts the focus of its economy from high-speed growth to high-quality development,” Hao said.

Based on the last version released in 2017, the new catalogue has 415 industries after the addition of 67 new ones. Over 80 percent of the newly added or revised industries are manufacturing-related, with an emphasis on high-end, intelligent and green manufacturing, including 5G core components, etching machines for integrated circuits, chip packaging equipment and cloud computing equipment.

Bai Ming, Deputy Director of the International Market Research Institute, said some countries may have concerns about exposing domestic hi-tech markets, such as 5G technology, to fiercer competition, forgetting that a key foundation of technological development is global resource allocation. Thus, to further its involvement in the global industrial chain, China needs to further embrace foreign capital.

Foreign investment is also encouraged in the productive service industry. The catalogue includes new entries for artificial intelligence, clean production, carbon capture and the circular economy, as well as e-commerce and cold chain logistics.

Focusing on central and western regions, the catalogue also adds labor-intensive, advanced and applicable technology industries, and supporting facilities, further helping these regions embrace relocated foreign-funded businesses.

The new catalogue is expected to give fuller play to the role of foreign investment in promoting China’s industrial growth, technological progress and economic restructuring, according to the NDRC.

Further Reforms Needed

The NDRC said the new negative lists and catalogue were released against rising unilateralism and protectionism as well as trade frictions that are weighing on economic globalization and cross-border investment. “China still faces severe challenges in attracting foreign investment, notably due to fierce global competition,” Hao said.

The country needs to follow international standards and develop a more favorable business environment to further make itself a magnet for foreign investment, she added.

Despite mounting external uncertainties, Sang said a growing number of foreign investors are keeping an eye on the Chinese market which remains attractive. “While there has been a scaling back of global foreign direct investment (FDI), China has still attracted a considerable amount of foreign investment,” he told Beijing Review.

China’s FDI rose 4 percent year on year to $139 billion in 2018, according to MOFCOM data. In the first five months of this year, its paid-in FDI in U.S. dollar-denominated terms increased 3.7 percent year on year to $54.6 billion and U.S. investment in China rose 7.5 percent.

China remains the most attractive investment destination in the world due to its complete industrial systems and large consumer market, the ministry said on June 13.

A report released by the NBS showed that the service sector has become a hot area for foreign investment, making up 68.1 percent of the country’s total foreign investment last year.

Furthermore, opening up of the service sector, in particular financial services, is picking up pace. Premier Li Keqiang announced in a speech during the World Economic Forum’s Annual Meeting of the New Champions in Dalian, northeast China’s Liaoning Province, on July 2 that the country will remove ownership limits for foreign investors in the financial sector in 2020, a year earlier than scheduled.

According to Nie, there is still much to do to improve China’s opening up, especially since licensing approval in many industries is still troubling many foreign enterprises hoping to enter the Chinese market. Meanwhile, the country needs to improve domestic intellectual property rights protection and make government procurement more open.

“To ensure the implementation of the negative lists, related departments are supposed to simplify administrative procedures and give full play to the role of the market,” she said.

On March 15, China adopted its first Foreign Investment Law to promote, protect and manage foreign investment, providing legal guarantee for the system of pre-entry national treatment plus negative list management, which will go into effect on January 1, 2020.

Based on this law, the country needs to move faster to formulate supporting trade and investment facilitation measures to better underpin the negative lists, Nie said.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +