RCEP Serendipity for Global Growth

RCEP is a philosophical commitment to the idea of multi-lateral trade agreements that smooth trade relationships.

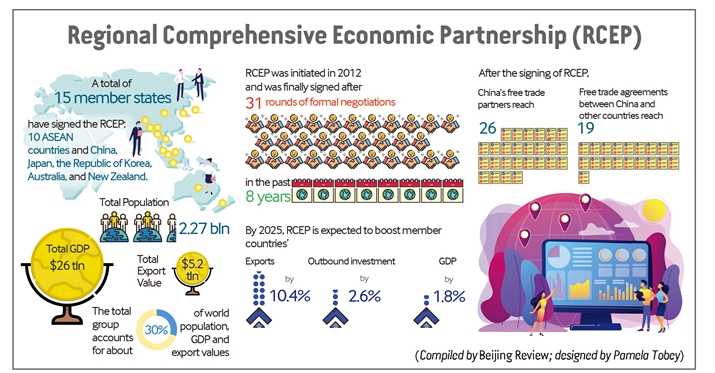

The RCEP is the cumulation of eight years work. To some extent it has already been overtaken by events but in other ways it is an agreement uniquely suited to our time and the post-COVID and post-Trump economy.

The eight-year period saw the increasing use of unilateral trade measures that splintered trading relations. RCEP is an antidote to that fracturing because it supports the development of common trade policy, regulations, and processes. It is uniquely suited to our time because it stands firm against the divisive unilateral tweets that have disrupted and soured trade relationships. RCEP was never designed to deal with this environment but it turns out it is the perfect solution at the right time. It’s pure serendipity.

RCEP is a philosophical commitment to the idea of multi-lateral trade agreements that smooth trade relationships.

But the agreement begs the question. How will these common processes be developed? This is a more complex answer that appears to wait on the formal ratification of RCEP later in 2021. However, the groundwork for the potential answer has been laid as China emerges from COVID with an enhanced suite of protocols and an adjusted economic structure. RCEP is not a Chinese trojan horse but elements of RCEP are consistent with the strands of emerging Chinese policy. Other member countries have yet to develop post-COVID economic responses, so China is a leading example.

China has a record of rapid readjustment to significant global crisis events. China quickly restructured and redirected its economy in response to the Global Financial Crisis. These swift moves essentially saved the world from a more severe depression. China’s response to COVID is a similar readjustment and reorientation. In another example in action, RCEP policy objectives are very compatible with these recent Chinese readjustments. It remains to be seen if other RCEP member countries are comfortable with this serendipity or if they see this as evidence of a deep conspiracy.

There are three critical areas that redefine China relations with the world and set a post-COVID environment in which regional trade will take place. The first of these areas is the concept of the dual circulation economy. The second is the introduction of the digital RMB and the way this disrupts the virtual monopoly of trade settlement by using advanced block chain solutions. The third, is the way these two developments enhance the Belt and Road Initiatives. These policy areas are compatible with the RCEP agreement and China’s activity in these areas may help shape the implementation of the agreement.

The dual circulation economy rests on a digital economy. The concept has two equally strong components: “internal circulation,” which refers to domestic economic activities, and “external circulation,” which relates to China’s economic links with the outside world. These links are entangled with RCEP objectives.

China wants to reduce the role of international trade in its economy and strengthen its domestic economy. China is uniquely vulnerable in its trade with physical choke points in the Straits of Malacca and the South China Sea. President Trump’s antics have exposed another chokepoint with China’s dependence on the SWIFT settlement system to complete cross border trade transactions.

Two solutions were created to break out of this choke point. The first was the Belt and Road Initiative. The second solution was greater independence for the RMB and Chinese capital markets. The digital RMB breaks the chokehold.

The second and third solutions are closely related so we consider them together.

The Belt and Road Initiative is a trade engagement policy. The original name, New Silk Road, reached back to the Tang Dynasty with its physical trade but the concept rests on the way China has always preferred to manage its trade and security relationships. RCEP is an additional mechanism that continues this tradition.

The Chinese trade system was built around mutual trade and the right, but not obligation, to trade. China preferred to use trade rather than force, as a method of ensuring border security.

This is a philosophical foundation of the Belt and Road Initiative where the objective is to secure borders through the enhancement of peaceful trade relationships with surrounding states. Essential to these relationships is a common set of protocols and procedures for cross border transactions so trade is smooth. RCEP provides another mechanism for China to pursue this philosophy consistent with the soft infrastructure aspects of BRI.

These aspects include trade Infrastructure with its regulatory environment; soft infrastructure of payment protocols and block chain certification; and capital infrastructure with investment and trade settlement.

This means that when you build a high-speed railway in Malaysia you also adopt the software to run the trains, to handle the ticketing, to manage the cross-border transfer of good and maintain the tracks. All of this rests on advanced hi-tech 5G and blockchain services.

When trade settlement in conducted in US dollars the entire trade structure is at the mercy on an unfriendly Tweet from Trump, or Biden. The development of capital independence is essential if the BRI is to achieve its smooth trade objectives. Part of that comes from creating a sovereign currency trade settlement system that is not dependent on a third party so trade settlement cannot be held to ransom by unilateral sanctions.

The digital RMB is the forerunner of an enhanced cross border trade settlement system built on a blockchain foundation. The RCEP is also an agreement to establish agreed cross border trade and settlement procedures. China has already established the outline of those processes with many of the 15-member countries already involved with BRI. The mechanisms and intent of RCEP first proposed eight years ago are now consistent with China’s new view of its economic relationship with the world. Now that’s serendipity.

The article reflects the author’s opinions, and not necessarily the views of China Focus.

Please indicate the source of the article for use of republishing.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +