U.S. Pressure Promotes Chinese Self-Sufficiency

By forcing China to make its own chips, the U.S. would not only give up high-paying jobs but would also force China to become self-sufficient.

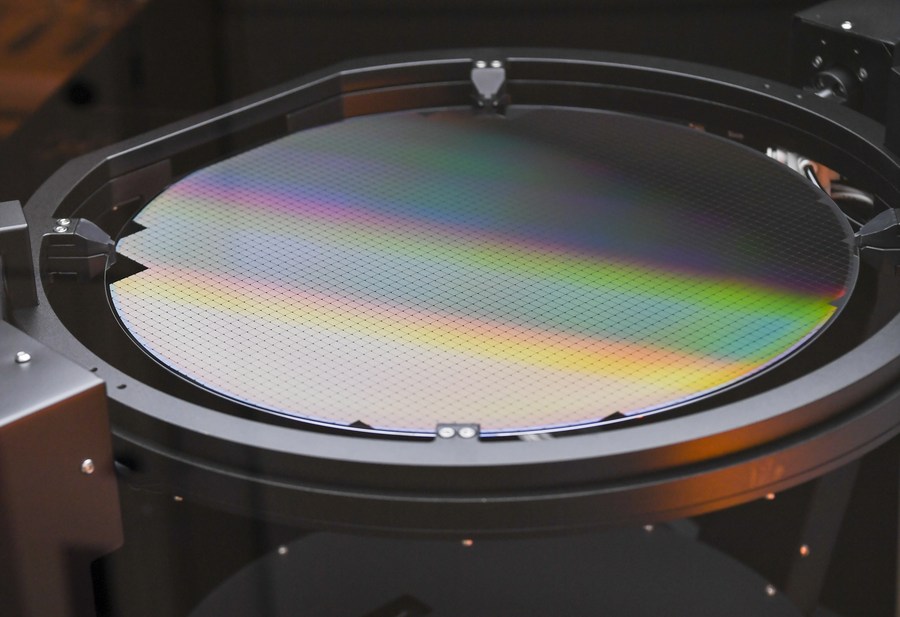

The sleek white boxes may be the size of small rooms, but they are the key to achieving precision on a microscopic scale. These boxes produce the world’s most advanced microchips, which feature millions or even billions of tiny transistors coexisting in only a few square centimeters of space, about the size of a fingernail.

These intricate lithography machines are made by ASML Holding, based in Veldhoven, the Netherlands. Its systems, each valued at over $150 million, use particular types of ultraviolet light to craft ultrasmall circuitry on small pieces of silicon to produce high-performance microchips.

The machines are now at the center of the China-U.S. technology conflict. In 2019, the Donald Trump administration lobbied the Dutch Government to block shipments of extreme ultraviolet (EUV) systems—machines vital for producing chips at the smallest production nodes—to China. The Joe Biden administration, in continuation, has recently raised the bar, expanding export restrictions to cover some of ASML’s less advanced deep ultraviolet (DUV) lithography machines as well.

The Dutch company said in a statement on January 1 that an export license for the shipment of some chipmaking equipment to China “has recently been partially revoked by the Dutch Government, impacting a small number of customers in China.”

On the following day, Chinese Foreign Ministry spokesperson Wang Wenbin countered the action, stating China opposes the U.S. coercing other countries into joining its technological blockade against China.

“Semiconductor production is a highly globalized industry. In a deeply integrated world economy, the U.S. hegemonic and bullying practices seriously violate international trade rules,” Wang said, urging the Netherlands to uphold market principles, respect contractual spirit and safeguard the free, open, fair and non-discriminatory international trade environment.

Limited impact

The license for the shipment of NXT:2050i and NXT:2100i lithography systems in 2023 was revoked by the Dutch Government. In the statement, the company said it had held recent discussions with the U.S. about the scope and impact of its export control regulations, without elaborating further.

Under U.S. pressure, ASML already restricts Chinese clients from buying its more advanced EUV systems. In June 2023, the Netherlands issued new rules, which took effect last September, requiring producers of advanced hardware used to make semiconductors need to obtain special licenses to export their products.

The aforementioned lithography machines are two of the three main systems in ASML’s DUV portfolio. The only one that can still be shipped to China’s mainland is the older model NXT:1980Di, which is restricted by the U.S. export rules, but not covered by rules pertaining to Dutch exports.

Demand from Chinese chipmakers for the DUV machine will remain strong despite the restrictions. “About 10 to 15 percent of ASML’s business in China will be impacted by the new export regulation, but still, demand should remain quite prosperous this year,” Shen Bo, President of ASML China, told China Daily during the Sixth China International Import Expo held in Shanghai last November.

According to Shen, in the third quarter of last year, ASML brought in $7.4 billion in net sales, and 46 percent of that came from China’s mainland, up from 24 percent logged in the second quarter.

In March 2023, ASML CEO Peter Wennick participated in the China Development Forum in Beijing. During his visit, he met with Chinese Commerce Minister Wang Wentao, who conveyed the Chinese Government’s commitment to fostering a favorable environment for foreign investors, and appealed for collaborative efforts to secure the stability of the global semiconductor industrial and supply chains.

Sources revealed to Chinese business media Caixin that during his weeklong visit to China, in addition to meeting with Wang, Wennick conducted staff meetings to instill confidence among Chinese team members. Moreover, he visited key customers such as Semiconductor Manufacturing International Corp., as part of his engagement in the region.

Stricter restrictions

On October 17, 2023, the Bureau of Industry and Security (BIS) at the U.S. Department of Commerce issued complex and extensive updates to the October 7, 2022, export controls restricting U.S. exports of advanced chips and semiconductor manufacturing equipment.

The move was made after Huawei surprised the world with the launch of a phone with a 7-nanometer chip, coinciding with the visit of the U.S. Secretary of Commerce Gina Raimondo to China in August 2023.

U.S. officials since then have been pressuring Japan and the Netherlands to align with U.S. policy against China. The pressure included the threat of a ban on sales of chip manufacturing equipment that uses U.S. technology. Along with companies from the United States, ASML and Japanese firm Tokyo Electron are the main manufacturers of equipment for chip production.

Vera Kranenburg, a China researcher at the Dutch think tank Clingendael Institute, told The New York Times that while ASML had made clear that it would follow the regulations, the company was already chafing under earlier regulations that barred it from exporting a more sophisticated lithography machine to China. “They’re of course not happy about the export controls,” she said.

The U.S. export control update also included restricting U.S. semiconductor companies from selling high-end microchips to China, Nvidia in particular, which last year created the A800 and H800 specifically for the Chinese market to comply with previous export rules.

The Wall Street Journal (WSJ) reported on January 7 that Nvidia’s customers in China are not so keen on buying its modified, lower-powered artificial intelligence chips for the Chinese market. China’s leading cloud companies have been testing Nvidia samples since November and said that they would order far fewer of its chips in 2024 than originally planned, the WSJ said.

The Chinese chip industry

At the beginning of the semiconductor industry, China was on par with the West, according to Feng Zhaokui, a scholar of Japanese studies at the Chinese Academy of Social Sciences.

However, during the 1980s and 1990s, as the global supply chain was becoming increasingly integrated, China decided it was unnecessary to domestically manufacture every component. The strategy adopted was to procure machines, chips and various parts from international markets. Consequently, investments in the research and development of semiconductors were significantly reduced.

In the context of increased sanctions and coercive measures against China, more efforts were made to encourage domestic chip manufacturers to overcome technological hurdles while deepening cooperation with other countries. From 2019 to 2021, the number of engineers working in the Chinese microchip industry rose from 500,000 to 600,000, according to ICwise, a Chinese semiconductor and electronics consultant.

“China can take full advantage of its super large market, which means the country has sufficient testing scenarios to verify its self-innovated technologies, lower its research and development costs and escalate the pace of product output,” Shi Hongxiu, a professor of economics at the National Academy of Governance, told China Daily.

Wang Jiangping, Vice Minister of Industry and Information Technology, said, “Persistent efforts are needed to tackle problems in crucial technologies.” One of the ministry’s top priorities during the 14th Five-Year Plan (2021-25) period is to advance the modernization of industrial chains and encourage companies to develop core technologies such as high-end semiconductor equipment.

Local governments in areas such as Guangdong and Zhejiang provinces, Shanghai and Tianjin have identified integrated circuits as one of their key industries during the 14th Five-Year Plan period.

Last year, sales revenue in the Chinese chip design sector reached $78.17 billion, up by 16.5 percent year-on-year and showcasing sectoral resilience amid U.S. export restrictions, according to preliminary data from the China Semiconductor Industry Association.

In an interview with Bloomberg in September 2020, Microsoft CEO Bill Gates said that by forcing China to make its own chips, the U.S. would not only give up high-paying jobs but would also force China to become self-sufficient.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +