Unlocking Finances

New measures lead China’s opening up in the financial sector to a higher level

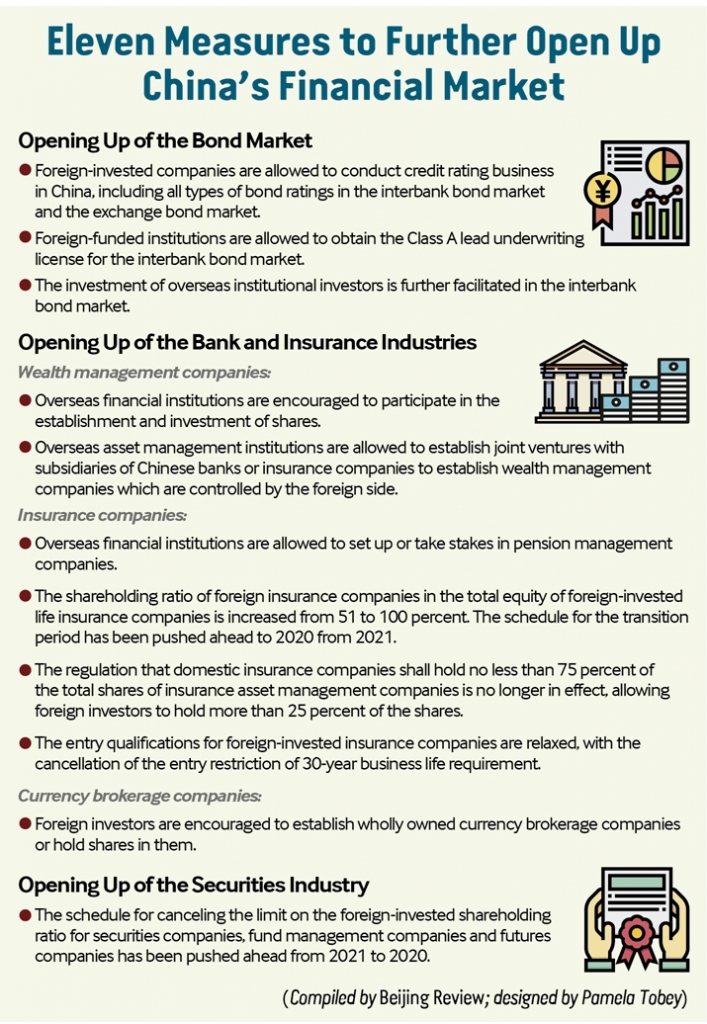

The Office of the Financial Stability and Development Committee of the State Council, China’s cabinet, announced 11 new measures to further open up the financial sector on July 20, in the latest move to help bolster and stabilize growth. The new measures cover multiple areas ranging from the bond market, banks, insurance companies, brokerage companies to the securities market.

This followed the release of the Special Administrative Measures (Negative List) for Foreign Investment Access (2018) on June 28 last year, which greatly lowered the market threshold and eased restrictions on market access for foreign investment in various sectors in its 22 measures. In the finance sector, China will cancel equity caps for foreign investment in banking, as well as relax foreign equity caps to 51 percent for securities firms, fund management companies, futures firms and life insurance companies. All foreign equity caps in the finance sector will be canceled by 2021.

International Standards

The two most important features of the new round of opening up are the acceleration of opening up and the opening up in new areas, Cao Yuanzheng, an economist with Bank of China International, an investment bank, told China Central Television’s finance channel.

Foreign brokers, who wish to start a securities business in China, must establish joint ventures. In 1995, China’s first joint venture investment bank, China International Capital Corp. Ltd., was established and today there are 14 joint-venture brokers in China. However, until it was scheduled for complete cancellation by 2021 last year, there had always been a limit on their shareholding ratio. Now, the new measures have pushed the cancellation ahead to 2020.

“The world economy is facing challenges on whether to continue globalization,” Cao said, adding that the new measures to push ahead of schedule reflect China’s clear position on championing globalization.

Lu Ting, chief economist at Nomura, an Asia-based financial service group, said bringing forward the schedule showcases China’s resolve to open up its market, which will encourage a batch of global financial enterprises to speed up and expand their business in the country.

The new measures also highlight reform in areas such as credit rating and pension management, which have not been mainstream financial businesses in China, Cao said.

“We lack experience compared to other countries that are proficient in techniques, experience and talent due to long histories of development in these areas,” he said. “However, there is a huge potential for these businesses in the future. If we want to get our foot in them, foreign investment has to come in and only in this way can the industry grow among fierce competition.”

On January 28, the U.S. firm S&P Global Inc. established a wholly-owned subsidiary in Beijing to conduct bond rating business, with certain limitations, in the interbank bond market. However, the new measures will allow it to carry out all types of bond ratings, and more international companies like S&P Global are expected to enter China’s credit rating market.

“The opening up of the credit rating business is of great importance since the bond market has a great impact on China’s capital market as well as the financing structure,” Cao said.

“If China wants to build a healthy bond market and attract more foreign investors, credit rating institutions can be a key factor,” Quan Dejian, Director of the United Overseas Bank Global Economics and Markets Research, said, adding that the entry of wholly owned foreign institutions will introduce mature credit rating models and further shore up the credibility of the Chinese market.

In addition, as China’s population increasingly ages, providing wealth management products for seniors has also become an innovative area.

“Services for seniors are a challenge for domestic and international companies and both of them will be at the same starting line,” Cao said. “Opening up not only provides international institutions with opportunities, but also meets China’s demand for financial development.”

With the public pension system as the mainstay, China’s pension management enterprises are still in their fledgling stage. At present, pilot pension management enterprises are under a strict approval system and so far, only one company has gotten through the process: the China Construction Bank Pension Management Co. Ltd. established in 2015.

The new measures welcome foreign-invested pension management enterprises—although still under a strict approval system—which will enrich market players, infuse vitality, introduce mature pension management experience and improve the standards of investment management, a representative from the China Banking and Insurance Regulatory Commission (CBIRC) said.

Growing Through Competition

Along with overseas pension management companies, there are three other measures related to the insurance industry which target overseas life insurance companies, insurance asset management companies and insurance companies, bringing a wave of change to the insurance market.

The easing of restrictions on the foreign-invested shareholding ratio will increase the voice of foreign shareholders so that the international business practices will be enhanced in the country, the CBIRC said.

Zhu Junsheng, an insurance researcher at the Development Research Center of the State Council, said the cancellation of the 30-year business life requirement that previously restricted entry “is in line with the current development of the international insurance market,” which allows innovative companies that integrate technology and insurance but have a short business life to enter China. It is meant to facilitate the innovation of domestic insurance products and business models.

In addition, foreign-controlled wealth management companies and wholly owned foreign currency brokerage companies are expected to enter the market under the new measures.

Currently, all subsidiaries of banks’ asset management business are solely invested in by Chinese commercial banks although they are allowed to be built jointly with overseas financial institutions. The new measures allow the joint ventures of wealth management companies to be controlled by the foreign side. Such an arrangement intends to introduce advanced asset management practices, promote the healthy development of the capital market, enrich market players and products, and meet diverse demands, according to the CBIRC.

Healthier Capital Market

By obtaining the Class A lead underwriting license, foreign-funded institutions are on an equal footing with domestic institutions. Previously, the scope of business for foreign-funded institutions was restricted to Panda bonds—renminbi-denominated bonds from a non-Chinese issuer sold in China. The new license will enable them to underwrite bonds like their domestic peers.

The move will further empower foreign institutions to serve the domestic real economy and is conducive to introducing foreign capital

for domestic enterprises to raise money through the issuance of bonds so as to solve financing difficulties, a spokesperson with the People’s Bank of China (PBOC), the central bank, said.

Currently, foreign investors can enter China’s capital market through the Qualified Foreign Institutional Investor, the RMB Qualified Foreign Institutional Investor and the Bond Connect programs, along with other channels. But the separation of different channels is inconvenient for the same overseas investment entities.

The new measures are aimed at facilitating overseas institutional investors in the interbank bond market. The PBOC spokesperson said the new measures reflect the demand for high-level opening up of the capital market.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +